Two industries that seem worlds apart—investment banking and digital marketing—are experiencing remarkably similar transformations. Both fields are data-intensive, both rely on strategic insights, and both are being fundamentally reshaped by artificial intelligence and data science. For professionals looking to build versatile, future-proof careers, understanding these parallel evolutions offers unexpected opportunities.

The Convergence of Finance and Marketing in the AI Era

Investment bankers analyze financial statements, market trends, and deal structures. Digital marketers analyze consumer behavior, search patterns, and campaign performance. While the end goals differ, the underlying skill sets are converging rapidly. Both professionals now need to:

- Process and interpret large datasets

- Make data-driven predictions

- Leverage AI tools for efficiency

- Communicate complex insights clearly

- Balance automation with strategic judgment

This convergence is creating a new category of professionals who can move fluidly between finance and marketing roles, or apply skills from one domain to solve problems in the other.

How Investment Banks Use Digital Marketing and SEO

Investment banks may not seem like marketing-heavy organizations, but they increasingly rely on digital strategies for:

- Talent Acquisition and Employer Branding – Top banks compete fiercely for the best graduates. Their career pages, social media presence, and content marketing efforts now rival tech companies. SEO-optimized recruitment content helps them attract candidates searching for “investment banking careers” or “finance analyst positions.”

- Thought Leadership and Brand Positioning – Banks publish research reports, market commentaries, and economic analyses. Optimizing this content for search engines extends their reach beyond existing clients to potential customers and industry influencers.

- Deal Sourcing and Business Development – In an era where mid-market companies research advisors online, having strong digital visibility matters. Banks with well-optimized content about M&A advisory, capital raising, or sector expertise can generate inbound leads.

- IPO Marketing and Investor Relations – When companies go public, digital marketing plays a crucial role in building awareness, managing narrative, and reaching retail investors. Banks advising on IPOs need teams who understand both financial communications and digital distribution.

For professionals with an investment banking course background, adding digital marketing skills opens doors to corporate communications, business development, and fintech marketing roles within financial institutions.

How Digital Marketers Serve Financial Services

On the flip side, digital marketing agencies and in-house teams serving financial services clients need deep industry knowledge. A marketer working for a bank, asset manager, or fintech company must understand:

- Regulatory compliance in financial advertising

- Complex product offerings and their value propositions

- Industry-specific search intent and keyword strategies

- Trust-building in high-stakes financial decisions

Marketers who can interpret financial data, understand market dynamics, and speak the language of finance bring strategic value that pure marketing generalists cannot match.

In highly regulated and trust-sensitive industries such as banking and fintech, content formats that combine education, authority, and visibility deliver the strongest results. This is where the benefits of advertorials become especially apparent, as advertorial-driven campaigns allow financial brands to publish compliant, SEO-optimized content that builds credibility, supports complex decision-making, and improves long-term organic performance while maintaining full transparency with audiences.

Many financial brands also benchmark their offerings against listings on a money comparison website, using those platforms to refine messaging, highlight competitive advantages, and address gaps in customer perception.

The Role of Data Science in Both Fields

Data science is the common thread connecting modern investment banking and digital marketing. In investment banking, data science powers:

- Predictive financial modeling and valuation

- Risk assessment and portfolio optimization

- Market trend analysis and forecasting

- Automated due diligence and document processing

In digital marketing, data science enables:

- Customer segmentation and predictive analytics

- Attribution modeling and campaign optimization

- Search trend forecasting and content strategy

- Personalization engines and recommendation systems

Professionals who complete a data science course gain skills that transfer seamlessly between these domains. The ability to work with Python, SQL, machine learning libraries, and data visualization tools is valued equally in both industries.

Generative AI: The Great Equalizer

According to a recent industry analysis, global banks are already using generative AI to improve deal research, automate documentation, and enhance decision-making speed.

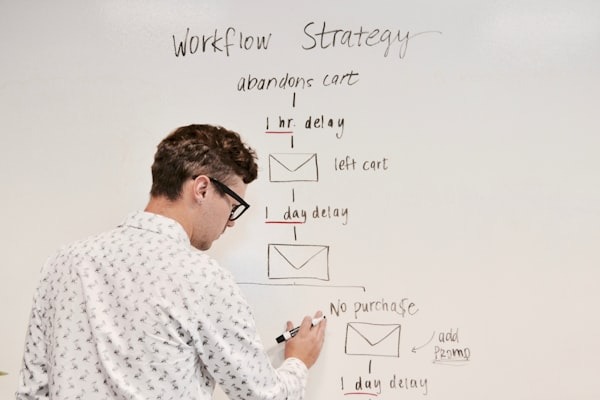

Generative AI is transforming workflows in both investment banking and digital marketing, creating parallel skill requirements.

In banking, AI tools are used for:

- Summarizing earnings calls and financial documents

- Generating initial drafts of pitch books and presentations

- Analyzing market sentiment from news and social media

- Automating routine financial modeling tasks

In marketing, the same underlying technology powers:

- Content creation and SEO optimization

- Ad copy generation and A/B testing

- Customer service chatbots and personalization

- Competitive analysis and market research

A generative AI course teaches professionals how these tools work, their limitations, and how to use them ethically and effectively. This knowledge is becoming non-negotiable in both fields, as organizations expect employees to leverage AI for productivity gains.

Hybrid Career Paths: Finance Meets Marketing

The intersection of these skills is creating entirely new career opportunities:

- Fintech Marketing Specialists – Professionals who understand both financial products, concepts like preferred return, and growth marketing are highly sought after by digital banks, payment platforms, and investment apps.

- Financial Content Strategists – Creating authoritative content about complex financial topics requires both domain expertise and SEO knowledge.

- Data-Driven Investment Communications – Investor relations and corporate communications teams need people who can analyze data, craft narratives, and optimize digital distribution.

- Growth Analysts in Financial Services – Roles that blend financial analysis, user analytics, and marketing strategy are emerging at the intersection of product, finance, and marketing teams.

- AI Implementation Consultants – Advisors who can help both banks and marketing agencies adopt AI tools effectively, understanding the use cases in each domain.

Building a Versatile Skill Set

For aspiring professionals, the strategic approach is clear:

- Start with a foundation – Whether through formal education in finance or marketing—such as pursuing a Baylor online marketing MBA —establishing core domain knowledge is essential for long-term career growth.

- Add analytical depth – Data literacy is non-negotiable. Understanding statistics, databases, and analytical tools creates optionality.

- Embrace AI fluency – Learn how to work alongside AI tools, prompt them effectively, and understand their capabilities and limitations.

- Develop cross-functional awareness – Finance professionals should understand marketing fundamentals; marketers should grasp basic financial concepts.

This combination makes you valuable in traditional roles while opening doors to hybrid positions that didn’t exist five years ago.

What Employers Are Looking For

Organizations across both sectors increasingly seek candidates who can:

- Translate complex data into actionable insights

- Navigate both quantitative analysis and creative strategy

- Use AI tools to amplify their productivity

- Communicate effectively with technical and non-technical stakeholders

- Adapt quickly to new technologies and methodologies

These are not separate skill sets for separate industries—they represent a unified competency profile for the modern knowledge worker.

The Future Belongs to Versatile Professionals

As AI and data science continue to evolve, the boundaries between industries will blur further. The skills that make you effective in investment banking—analytical rigor, attention to detail, strategic thinking—are the same skills that drive success in data-driven marketing. Similarly, the creativity, communication ability, and user-centric thinking valued in marketing enhance financial advisory and client relationship management.

In global financial hubs like New York, firms navigating this shift often work with experienced HR consultants in New York to structure cross-disciplinary teams capable of operating across finance, marketing, and AI-driven functions.

As professionals increasingly operate across borders and digital ecosystems, staying connected becomes essential to applying these cross-industry skills in real time. Reliable tools such as eSIM internet enable seamless global connectivity, allowing marketers, analysts, and financial advisors to access data, collaborate remotely, and make informed decisions without interruption in a fast-moving, tech-driven environment.

The most successful professionals will be those who refuse to be boxed into a single domain, who see patterns across industries, and who build skill sets that create value wherever data-driven decisions matter.

Conclusion

AI and data science are not just transforming investment banking and digital marketing separately—they are creating a bridge between these fields. Professionals who invest in developing capabilities across finance, marketing, data analytics, and AI position themselves at the forefront of this convergence. Whether your background is in banking or marketing, the opportunity to expand your toolkit has never been greater, and the career possibilities have never been more diverse.

![The Ultimate Guide to Productized Services [Examples Included]](https://clickraven.com/wp-content/uploads/2024/08/productized-services-scaled.jpg)